In Texas, navigating Texas title loans regulations involves transparent terms, a clear valuation process, and borrower rights, fostering transparency and control over assets. Eligibility criteria vary based on vehicle type, ownership status, and repayment ability; credit checks are not performed. The swift process begins with providing vehicle details and documents, leading to loan approval with flexible terms, including Boat Title Loans. This alternative financing option is ideal for urgent funding needs, offering convenience and direct deposit options.

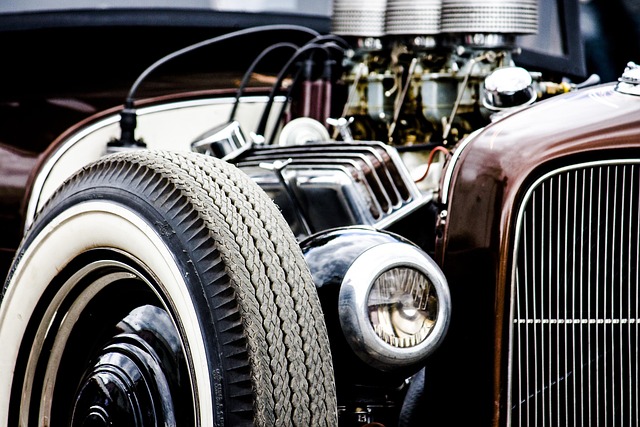

In the vibrant landscape of Texas, understanding car title loan regulations is crucial for folks seeking quick financial solutions. This article navigates the intricate details, providing a comprehensive guide on what vehicle types qualify for Texas title loans. From sedans and trucks to SUVs and classic cars, we explore the eligibility criteria in light of stringent state laws. Learn how to secure these short-term loans efficiently, offering a lifeline during unexpected financial challenges.

- Understanding Texas Title Loan Regulations

- Eligibility Criteria for Different Car Types

- The Process of Securing a Title Loan in Texas

Understanding Texas Title Loan Regulations

In Texas, understanding the regulations surrounding Texas title loans is crucial for both lenders and borrowers. These laws are designed to protect consumers while ensuring fair lending practices. When considering a Texas title loan, it’s important to be aware of the rules that govern the process. Lenders must provide clear terms and conditions, including interest rates, repayment schedules, and the specific rights and responsibilities of both parties.

The state’s regulations also mandate a thorough vehicle valuation process. This means lenders need to assess the market value of your vehicle accurately to determine the loan amount. Additionally, borrowers have certain rights, such as the ability to repay the loan in full or sell the vehicle without penalty if they choose not to proceed with the loan. These regulations promote transparency and help ensure that individuals can access fast cash through these loans while maintaining control over their assets.

Eligibility Criteria for Different Car Types

In Texas, the eligibility criteria for obtaining title loans vary based on the type of vehicle you own. For cars, trucks, SUVs, and motorcycles, lenders typically assess the vehicle’s value, its condition, and your ability to repay the loan. Since Texas title loans are secured by the vehicle, the lender will require clear ownership and a valid registration. The vehicle must be insurable, and you’ll need to provide proof of income and identification. Interestingly, even if you have poor credit or no credit at all, it’s still possible to apply for Houston title loans, as lenders don’t perform traditional credit checks.

Instead of focusing on your credit history, they prioritize the value of your vehicle and your ability to meet repayment terms. For older or high-mileage vehicles, the loan-to-value ratio might be lower, but you can still secure a loan through this alternative financing method. The title transfer process is straightforward and allows you to keep using your vehicle while repaying the loan. This flexibility makes Texas title loans an attractive option for borrowers who need quick access to cash without the stringent requirements of traditional loans, especially for those with limited credit options.

The Process of Securing a Title Loan in Texas

Securing a Texas title loan is a straightforward process designed to be efficient and convenient for borrowers. The first step involves visiting a reputable lender or applying online, where you’ll need to provide essential information about your vehicle. This includes details like the make, model, year, and current mileage, along with proof of ownership through the vehicle’s registration documents. Lenders will assess the value of your car and determine the maximum loan amount based on its condition and market price.

Once approved, you’ll need to sign a loan agreement outlining the terms, including interest rates and repayment schedules. A key aspect of this process is that lenders in Texas offer flexible options like direct deposit for loan funds. For those looking to borrow against assets beyond cars, Boat Title Loans can also be considered under similar processes. The entire Title Loan Process is typically completed within a short time frame, making it an attractive solution for emergency funding needs or unexpected expenses.

In conclusion, understanding the eligibility criteria for Texas title loans is essential for those seeking quick financial solutions. The state’s regulations allow various car types, including cars, trucks, SUVs, and motorhomes, to qualify for title loans. By following a straightforward process that involves vehicle appraisal, application submission, and clear title ownership, individuals can access much-needed funds. When considering a Texas title loan, it’s crucial to familiarize yourself with the local laws and choose reputable lenders to ensure a positive borrowing experience.